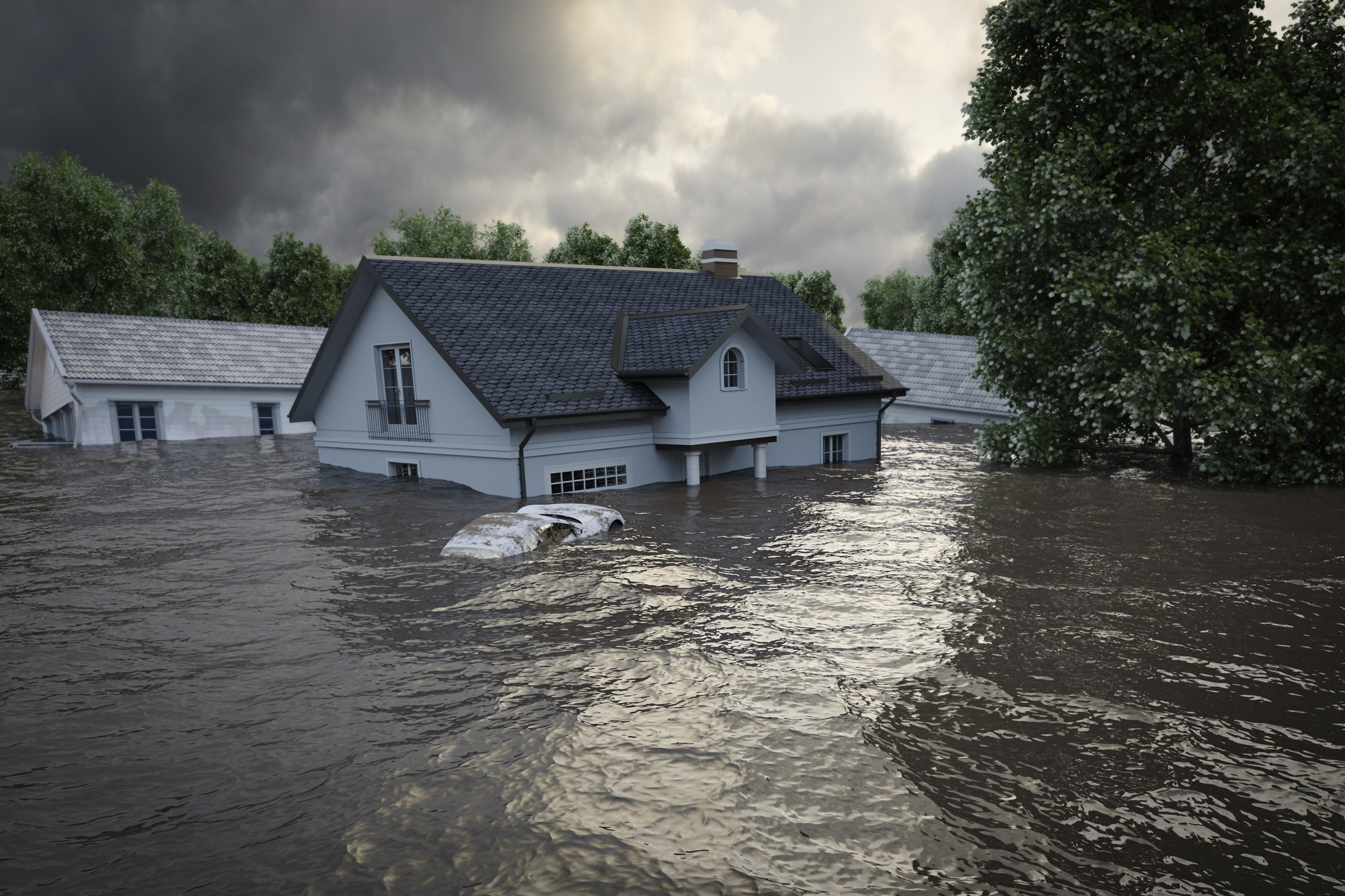

Rising rivers, torrential rains, and unpredictable weather have Iowans watching the news a little more closely.

As we head into spring, summer, and eventual rainfall that comes with it, we’re left wondering whether our homes are at risk. Don’t wait until the storm clouds roll in to wonder, “Does homeowners insurance cover flooding?”

Know if you’re at risk, whether flood damage is covered under your insurance umbrella, and how to improve your coverage.

Is Your Home at Risk?

Has your home experienced a close call? Wondering if you’re at risk? Thankfully, there’s a tool to see if your home is at risk and factors that may inhibit or exacerbate flooding.

The Iowa Flood Center at the University of Iowa has developed an interactive, online map so users can see how potential flooding can affect them.

Based on the same interface as Google Maps, the Iowa Flood Information System is an intuitive web application that shows the latest information on weather conditions, stream and river data, forecasts, and of course, flood alerts.

Flood damage is always a burden that we’d rather not struggle with, but with the Iowa Flood Information System, you can stay updated with minute-by-minute information and alerts.

If your area is prone to flooding, it’s time to ensure that your insurance covers flood damage.

Does Homeowners Insurance Cover Flooding?

In short, no.

Standard homeowners insurance usually does not cover flooding that’s caused by extreme weather conditions. Given that flooding is primarily caused by powerful weather patterns, it’s time to think about expanding your coverage or considering flood insurance.

Homeowners insurance is often used as an umbrella term for any issue your home may encounter. In reality, homeowners insurance is just one piece of the puzzle. Think of homeowners insurance as a package that can be tailored to your location, risks, and lifestyle.

Already thinking about that heavy rainfall and rising river? Don’t worry; there are options. Homeowners insurance can usually be amended or expanded to include flood protection. Even homes that are considered high-risk may still be eligible for flood policies.

Determine whether your home is at risk of flooding by checking out the Iowa Flood Center map.

Even if your home is not situated in a flood zone, there are other factors that affect flood insurance. These factors include:

- Age of the structure

- Number of people living in the structure

- Number of floors

- Contents

- Location of the lowest floor

Flood damage is an all-encompassing mess for the lower level of a home. Talk to your home insurance agent to determine what policy is best for your family and home.

Expanding Your Coverage

If the answer to, “Does homeowners insurance cover flooding?” doesn’t sit well with you, it’s time to rethink your coverage.

The agents at Centro Insurance have provided home insurance, business insurance, auto insurance, and so much more for Iowa residents and businesses for years. Our trusted agents have made it their mission to provide honest answers, helpful guides, and affordable premiums.

Don’t wait for the water to rise before to begin the process. Request your flood insurance quote today by filling out our easy, online form.

**Please note most flood policies are subject to a 30 day waiting period**